Loans and Bonds

As of February 27, 2026

This table can be scrolled horizontally.

| Loan | Lender | Amount (JPY million) |

Interest Rate (%) |

Borrowing Date | Maturity |

|---|---|---|---|---|---|

| Term Loan 23 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Aozora Bank |

7,000 | 1.0290% ※ |

August 25, 2023 | August 25, 2026 |

| Term Loan 24 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Fukuoka Bank Nishi-Nippon City Bank |

1,200 | 0.96400% ※ |

August 31, 2023 | August 25, 2026 |

| Term Loan 25 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank |

3,300 | 1.23900% ※ |

August 31, 2023 | August 31, 2028 |

| Term Loan 26 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank |

3,500 | 1.20200% ※ |

November 30, 2023 | November 30, 2027 |

| Term Loan 27 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank |

3,500 | 1.49900% ※ |

November 30, 2023 | November 30, 2029 |

| Term Loan 28 | SMBC | 400 | 1.39800% ※ |

January 31, 2024 | July 31, 2029 |

| Mizuho Bank | 300 | ||||

| SBI Shinsei Bank | 300 | ||||

| Resona Bank | 200 | ||||

| Fukuoka Bank | 300 | ||||

| Nishi-Nippon City Bank | 300 | ||||

| Term Loan 29 | SMBC | 450 | 1.40100% ※ |

February 29, 2024 | July 31, 2029 |

| Term Loan 30 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Fukuoka Bank Nishi-Nippon City Bank |

4,500 | 1.58500% ※ |

February 29, 2024 | August 30, 2030 |

| Term Loan 31 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Nishi-Nippon City Bank |

2,220 | 1.63100% ※ |

April 30, 2024 | April 30, 2030 |

| Term Loan 32 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Aozora Bank |

3,000 | 1M JPY TIBOR+0.485% (floating) |

November 29, 2024 | July 30, 2027 |

| Term Loan 33 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Aozora Bank Fukuoka Bank Nishi-Nippon City Bank Kansai Mirai Bank |

3,550 | 1M JPY TIBOR+0.525% (floating) |

February 4, 2025 | July 31, 2028 |

| Term Loan 34 | SMBC | 2,000 | 1M JPY TIBOR+0.65% (floating) |

August 29, 2025 | February 28, 2031 |

| Term Loan 35 | SMBC Mizuho Bank SBI Shinsei Bank Resona Bank Fukuoka Bank Nishi-Nippon City Bank |

2,000 | 1M JPY TIBOR+0.65% (floating) |

February 27, 2026 | August 31, 2031 |

| Total | 38,020 | - | |||

※ Fixed via interest rate swap

(Note) The average interest rate of interest-bearing liabilities is 1.23228% as of July 31, 2025.

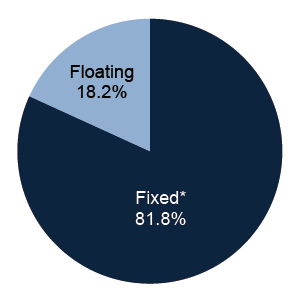

Distribution of Fixed vs. Floating Rate

※ Includes items fixed via interest rate swaps

Short-Term vs. Long-Term Loans

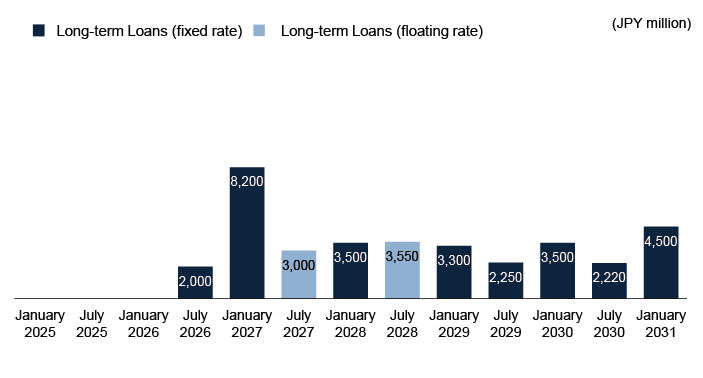

Distribution of Loan and Bond Maturities

Note: The distribution of loan repayment dates is calculated based on the total loans outstanding as of the maturity date of each loan.